Juicebox partners with wholesale investment firm to launch digital trading platform

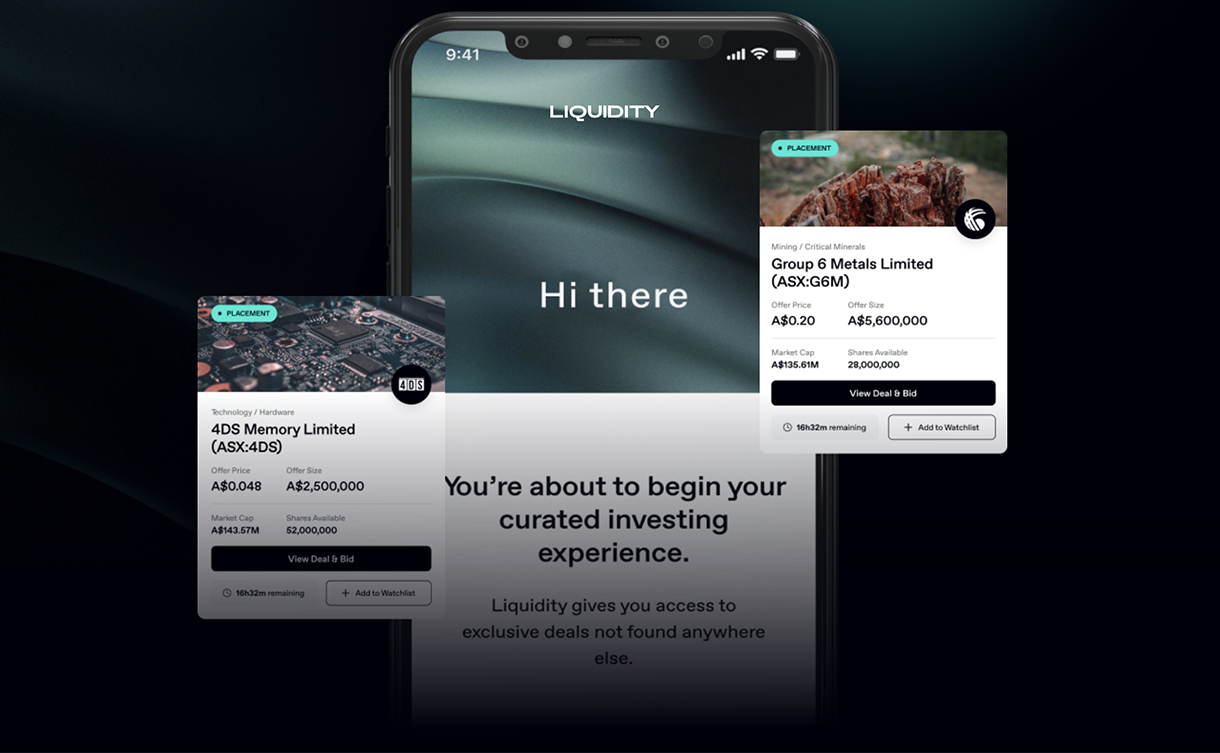

Newly launched digital trading platform Liquidity.com.au is the result of an unlikely partnership between a traditional boutique investment firm and digital agency, Juicebox.

The platform, which officially launches this month, is the end result of a conversation between the founders of Perth’s Juicebox and Mac Equity Partners founder, Bryant McLarty more than two years ago.

Having plied his trade for the last 25 years, McLarty said he was becoming increasingly frustrated with the time and labour intensive traditional broking practices that still dominate the industry today, as well as the rapidly decreasing margins the industry was forced to accept.

McLarty said: “I could see the writing on the wall for firms like ours and I can tell you it wasn’t a particularly popular viewpoint with the brokers in my office.

“However, I could see that we could still operate, albeit in a far more cost efficient and streamlined way, and bring the majority of our clients with us on the journey once they could see that there were so many advantages to trading and maintaining their portfolios on Liquidity.

“We still offer the traditional service and we still pick up the phone to our clients on a regular basis, however we have just digitally streamlined what was, and always has been, a ridiculously labour intensive, manual, outdated way of executing a trade and of raising money.”

He describes Liquidity as: “A step beyond purely functioning as a digital trading platform. It seeks to improve the experience for parties on all sides of the investment transaction. It is aimed at both companies seeking to raise funds and is open to sophisticated investors – or 708s – via a simple online verification process.”

Once verified, Liquidity members are offered exclusive access to a range of curated investment opportunities, listed and unlisted, at different investment stages that meet their investment needs as well as access to a live ASX trading screen.

The platform offers unprecedented functionality that its competitors do not, including early-stage participation in listed and unlisted capital raises based on their interest and investor profile, a digital sign off process for offer letters, automated, secure identity verification and secure links to a Macquarie bank account.

Users are then rewarded with Liquidity dollars (LQDs) for every trade, which are either credited back to their accounts, redeemed in cash, utilised as brokerage fees, or used to purchase a range of premium products or exclusive experiences from the LQD members’ lounge.

McLarty added: “It works for the investors, and it also works for the companies looking to raise capital.

“Companies seeking to raise funds, either at seed level or to underwrite ongoing growth, can do so at a far more competitive rate because we don’t carry the operational cost burden of a traditional broking house while being able to expose them directly to a prequalified pool of investment ready sophisticated investors.

“We are also intending to operate as a cooperative of sorts working with other boutique broking firms across the country, giving them and their clients access to the platform, to the deals on offer and the ability for them to list their deals on the platform and gain access to an even broader pool of investors, essentially, we are offering far more than just a super-efficient trading platform.

“They still retain their own clients but have the ability to utilise the platform which is really important for the smaller investment houses which are increasingly being squeezed out by the venture capitalist-backed large broking houses.”

For Juicebox strategist and co-founder, Joel Pember, partnering with McLarty to develop the Liquidity platform represented “thinking upstream” in terms of his own agency’s growth trajectory and increased exposure to higher level discussions.

Pember said: “We were definitely thinking upstream with this project and saw it as a partnership opportunity right from the beginning rather than the traditional agency-client relationship that is our bread and butter.

“Partnering with Liquidity allows us to gain access to boardroom, executive level conversations at critical moments when companies are seeking to raise funds and when they are, or should be, looking at the ways to leverage ‘brand and digital strategy’ to enhance and unlock additional value for their ventures.

“While it is not always recognised at boardroom or C-suite level, in the lead-up to raising capital, it is exactly the time when they should be thinking more deeply about their strategic opportunity and considering how experience design and technology can be deployed to change the game and deliver significantly greater performance.”

“We have found at times, especially in terms of larger corporate brands, that agencies are typically restricted to working with the communications or marketing suite and their respective budgets rather than the leadership team and that’s ideally where we need to be.

“The Liquidity platform itself is a demonstration of our capability. We have successfully transformed a broking firm into a scalable platform solution that benefits all parties involved in investment transactions.

“We’re using the latest web technologies to improve the investing experience by providing members with increased levels of control and secure access to real-time information.

Pember said Liquidity is focussed on delivering best-in-class amplification of a company’s story via the platform’s news sharing capabilities and integrations that are built to share key company information and milestones in real time with both investors and media.

“The Liquidity platform and support service offering has been in development for over two years with a significant beta testing period and trials completed in the first half of 2023, allowing us to now confidently go to market.”

In terms of the platform’s targeted investor pool, McLarty said that the number of 708 or wholesale investors was continuing to grow with many Australian investors unaware that they qualified.

“There’s also a change occurring in terms of the transfer of intergenerational wealth with a younger, more digitally savvy group making key investment decisions and an increased level of share trading among younger people who see it as a more effective way of growing their wealth than just leaving it in low interest-bearing accounts,” says McLarty.

He said while it is difficult to ascertain the exact number of sophisticated investors in Australia, 16% or 3.25 million people qualify to be potential 708s. Initial targets are relatively modest with a target of 500 members by the end of 2024 and 5000 by the end of the following year.

As the platform evolves and membership grows, the team behind Liquidity expect to forge partnerships with leading brands to grow the LQD marketplace, create exclusive member networking opportunities and continue to expand and diversify access to quality products, including blockchain enabled infrastructure for proven digital assets.