Australian and New Zealand ad markets maintain growth in 2024 – MAGNA Global Ad Forecasts

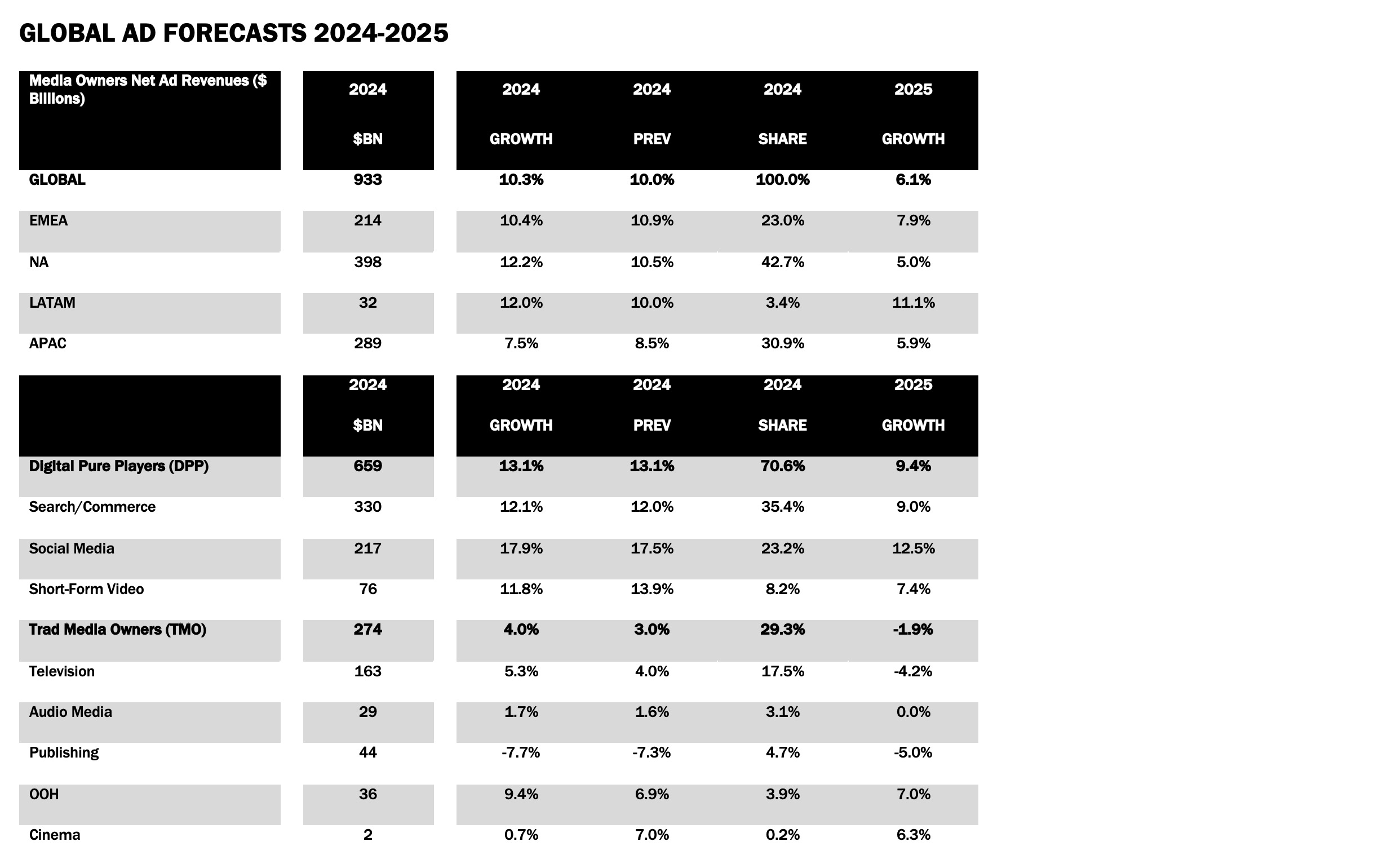

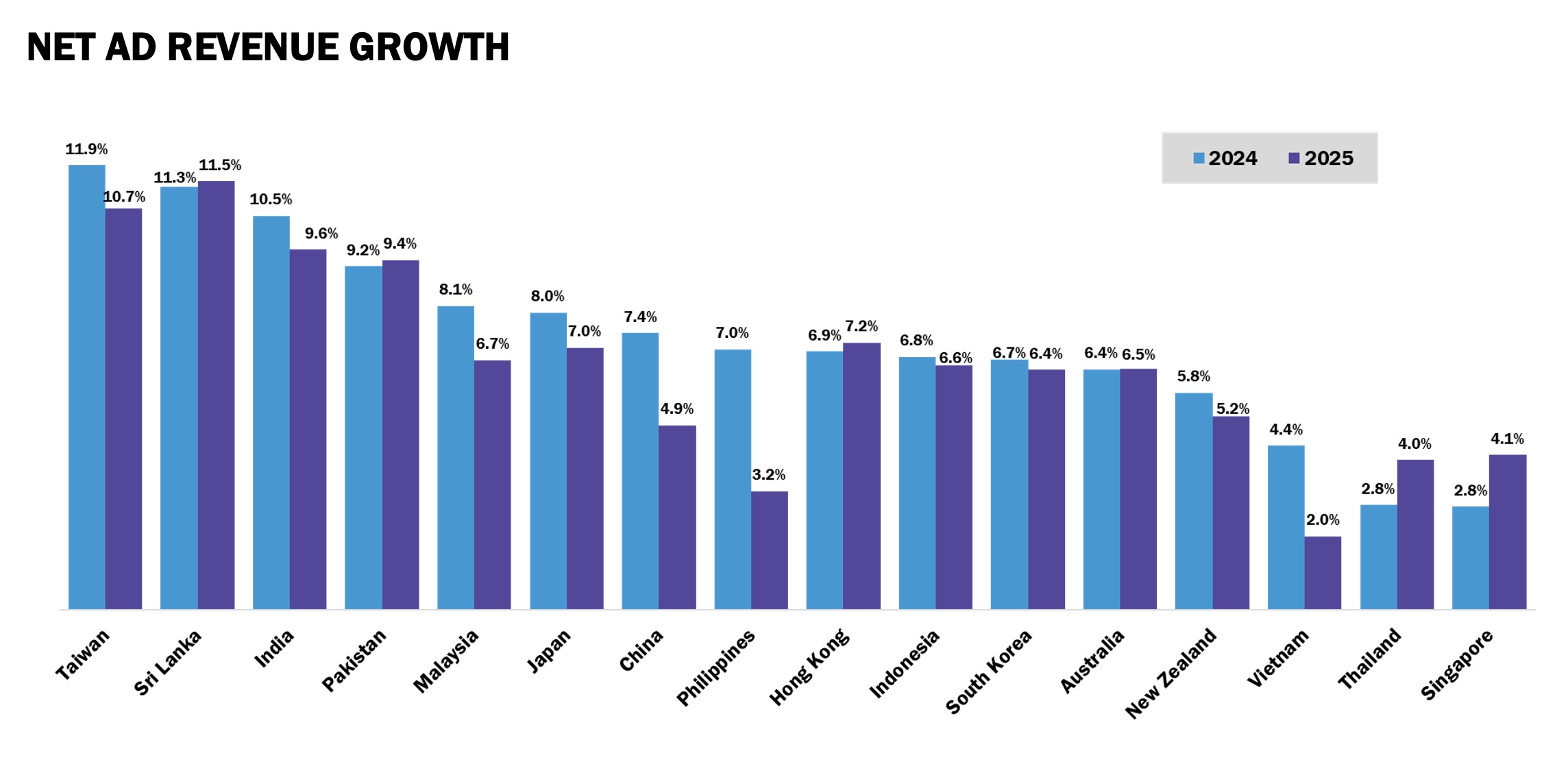

Australia and New Zealand’s advertising markets have experienced steady growth in 2024, reflecting global trends outlined in MAGNA’s latest Global Ad Forecast. While global advertising revenues soared to $933 billion (+10% year-on-year), Australia’s growth rate of +6% positions it in a more subdued tier compared to the standout performance of markets such as France (+12%), the US (+12%), and India (+11%).

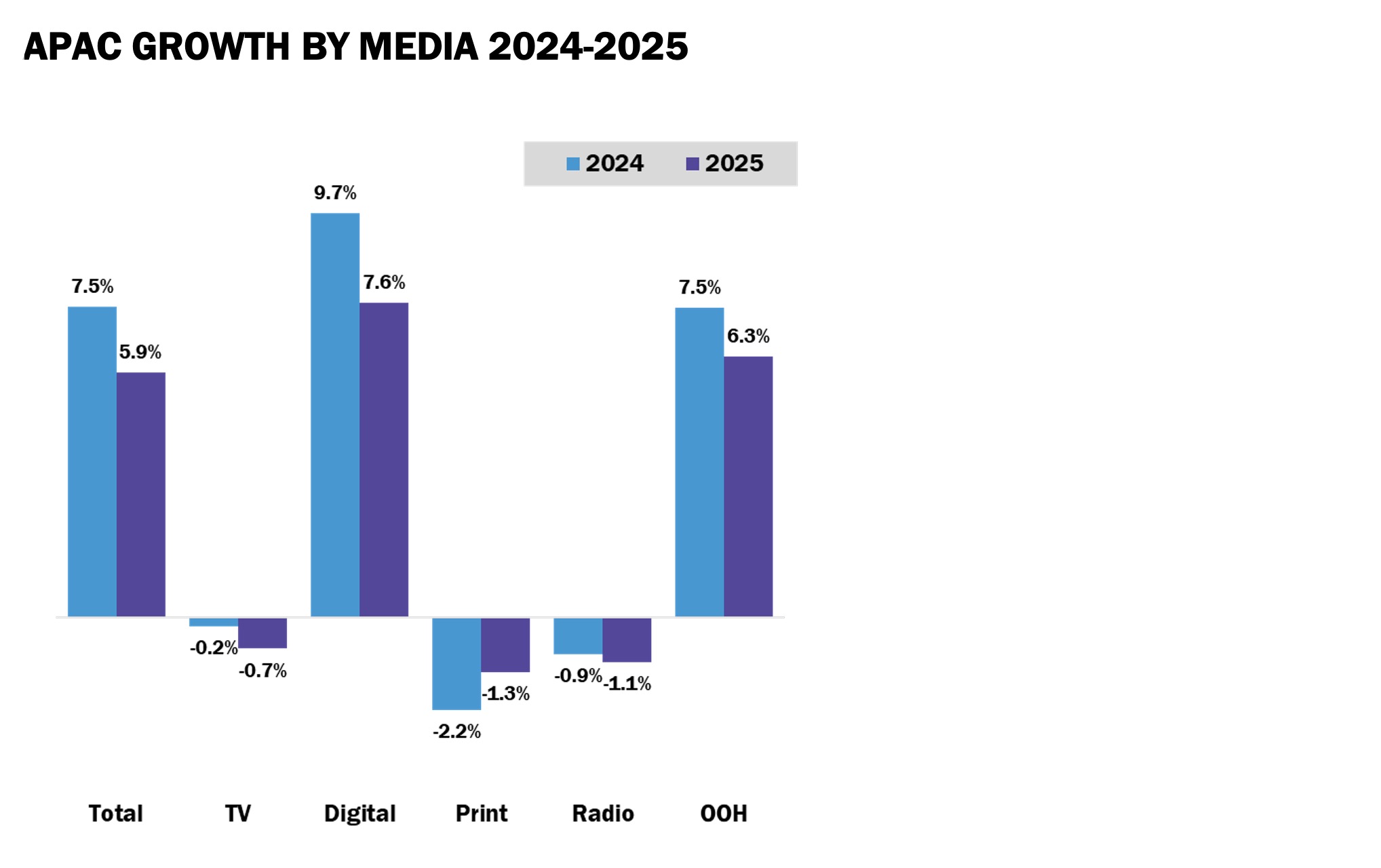

Australia remains a digitally driven advertising market, with Digital Pure Players (DPP) accounting for an increasingly dominant share of ad spend. MAGNA’s report highlights that digital revenues represent 76% of total APAC ad budgets, with Australia among the leaders in the region for digital advertising innovation.

The 2024 Paris Olympics provided a modest boost to television advertising in Australia, contributing to a +0.1% stabilisation of TV budgets. However, traditional media owners (TMO) saw only limited growth, with more significant strides in their adoption of non-linear ad formats, such as ad-supported streaming. In Australia, digital revenues now account for 31% of total traditional publisher revenues, signaling a progressive pivot towards integrated digital offerings.

Despite this growth, Australia’s ad market expansion of +6% fell behind global heavyweights like the US and UK, as well as regional leaders such as India (+11%). Economic pressures, including lingering inflation and cautious consumer spending, have contributed to this tempered growth.

New Zealand, while not explicitly detailed in the report, typically aligns closely with Australian trends in advertising. Digital-first strategies remain critical in this smaller market, where social media and search dominate ad spend. Advertisers in New Zealand are also adapting to the global surge in short-form video and mobile-led campaigns, catering to increasingly digital-native audiences.

Key industry trends impacting ANZ

MAGNA’s insights reveal that global trends are shaping industry verticals in ANZ. Sectors like automotive (+16%), finance/insurance (+15%), and food and beverage (+12%) are driving growth, buoyed by a recovery in consumer confidence and increased investment in AI-driven marketing.

Additionally, the impact of global cyclical events such as the US Presidential election, Paris Olympics, and Copa America was less pronounced in Australia and New Zealand. Unlike the US, where cyclical events contributed $10 billion in incremental ad sales, ANZ markets primarily benefited from the Olympics, albeit on a smaller scale.

A look ahead

The MAGNA report forecasts continued digital dominance across APAC, with digital advertising projected to represent 82% of budgets by 2029, up from 76% in 2024. In Australia, this evolution is mirrored by the growth of retail media networks and the sustained rise of search and social platforms.

While the global advertising market edges closer to the trillion-dollar mark, ANZ remains focused on leveraging digital innovation and adapting to shifting consumer behaviors. Traditional media players must continue their pivot to digital formats, and advertisers must navigate a challenging economic environment to sustain growth in 2025 and beyond.

Leigh Terry, CEO of IPG Mediabrands APAC, summarises the region’s potential: “The future is bright for digital advertising in APAC, with its share of total budgets projected to reach 82% by 2029. Despite some economic uncertainties, the overall market remains stable and poised for continued growth.”