SBS challenges media industry to open their eyes to the 35-64s demographic

National broadcaster SBS has used its 2025 Upfronts to challenge the industry over their ongoing focus on “outdated” narrow demographics, such as 25-54s, when it comes to buying audiences on television and broadcast video on demand.

Speaking at the Sydney Town Hall event, Keiran Beasley (pictured right), National Sales Manager – TV and Digital, argued that smart brands were increasingly changing their briefs to media owners to recognise that the historical 25-54s demographic is no longer the pre-eminent category for driving consumer spend.

“It is no secret that Australians are facing a challenging economy and, in particular, a cost-of-living crisis which is particularly affecting younger people,” said Beasley. “Our challenge for this room amid a difficult economic environment is: why are we continuing to make the historical – and daresay I say outdated – demographic of 25-54s the keystone of television buying?

“Smart marketers are already seeing the benefits of briefing us against a 40+ or 35-64s demographic. The research clearly highlights that 40+ demographics have a strong disposable income and are looking to spend.”

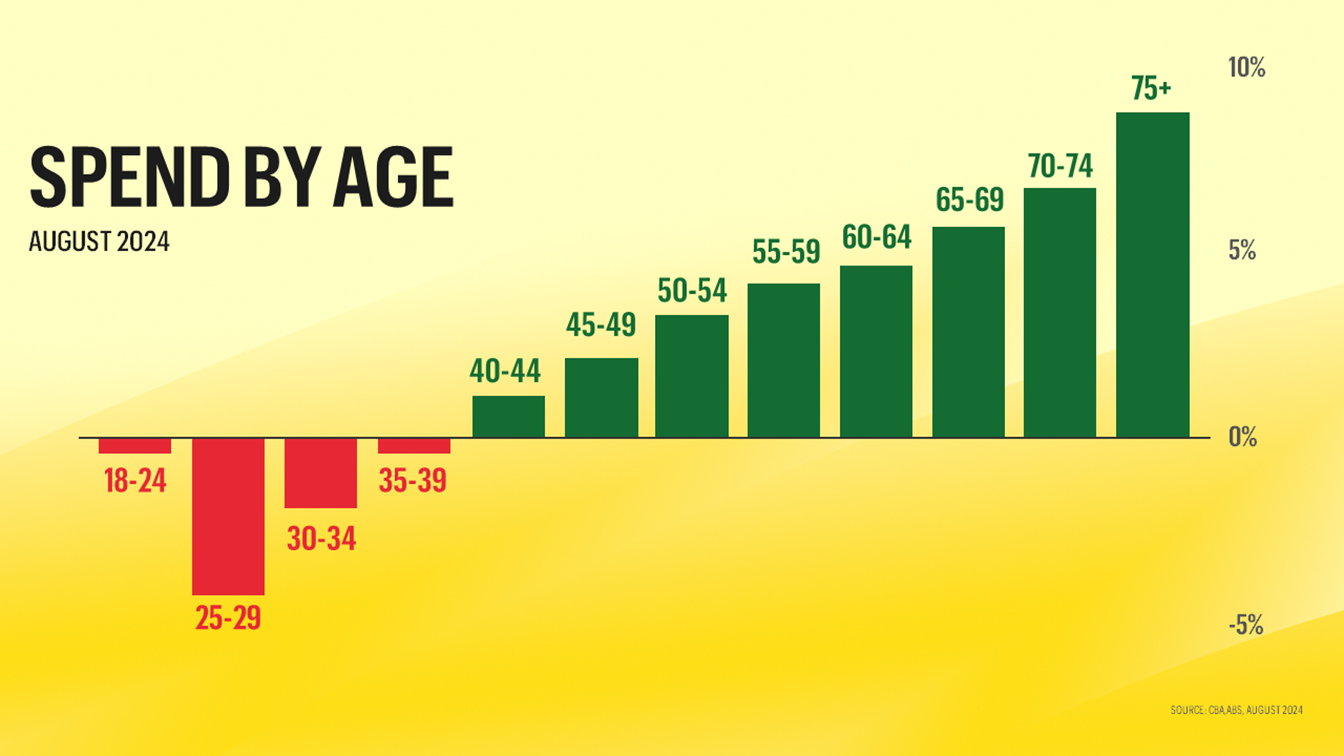

Beasley highlighted recent research from CommBank which showcased how total spend was going backwards among younger demographics, but was strong among older age groups.

“The numbers don’t lie. In the current economy those aged 25-34 have reduced cash for discretionary items and are eroding their savings for daily essentials. Now compare that to those aged 40+ who have higher disposable incomes and greater financial security.”

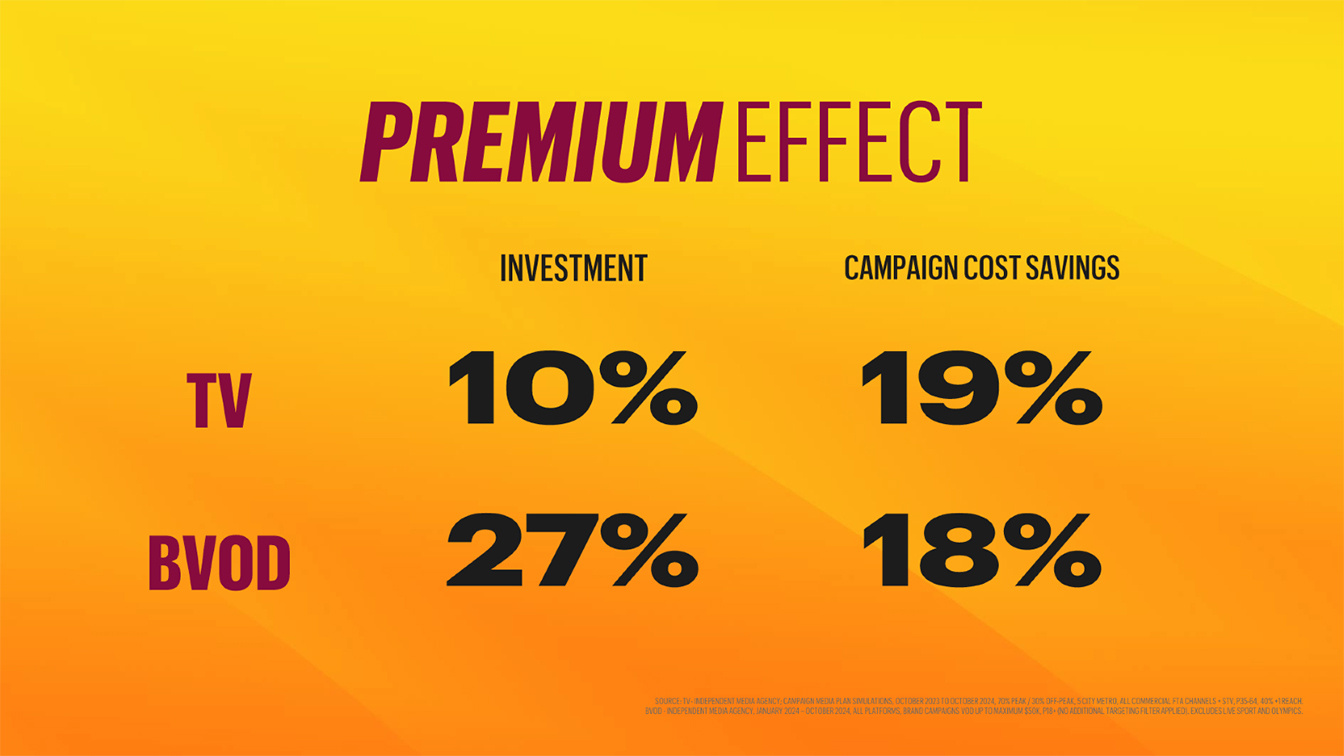

SBS also launched “The Premium Effect” research, which highlights the cost-per-reach efficiency across TV and BVOD that can be achieved by allocating 10% of a client’s linear TV budget and 27% of the BVOD budget to SBS, delivering 19% and 18% campaign cost savings respectively.

“This independent research once again proves the value of including SBS as an important part of your campaign,” said Beasley. “We have updated our research – to validate the findings for a VOZ world. At a time of transformation in the TV landscape SBS remains an essential part of any TV and BVOD schedule.”

Commenting on the need for a demographic rethink and the new “The Premium Effect” research, Jane Palfreyman (pictured left), SBS Chief Marketing and Commercial Officer, added: “For marketers and agencies, SBS needs to be part of their media schedule. We have a high value, hard to reach audience that is difficult to find elsewhere.”

The network also highlighted its unique advertising proposition of an uncluttered environment with only five minutes of advertising per hour and an audience which is very different to its free-to-air TV rivals.

“When you buy SBS you are buying a different type of consumer,” said Beasley. “The research shows clearly it’s not the same viewer as our traditional counterparts and especially with SBS On Demand we are playing in a premium pool of viewers who are not always easy to reach elsewhere.”